- Cryptogram

- Posts

- Why Crypto Fell So Fast (and What comes next)

Why Crypto Fell So Fast (and What comes next)

Are you still trading BTC like this is a dip?

Are you still trading BTC like this is a dip?

21 November 2025

This week, crypto behaved like it woke up on the wrong side of the blockchain. Bitcoin tripped over support, altcoins staged a synchronized nosedive, and liquidity stepped out for a “quick break” and never returned. Traders, meanwhile, have been doing the emotional equivalent of refreshing the fridge every 10 minutes in the hope that something new appears, fully knowing it won’t.

But market mischief has a pattern: when things fall apart quickly, they usually reveal exactly what we need to pay attention to.

Bitcoin and the broader market suffered a sharp sell-off this week. BTC slipped below $87,000—a level not seen since spring—marking a drop of roughly 33% from its October peak, while Ethereum and other altcoins were hit even harder. Volatility spiked to levels reminiscent of major cycle tops, with the Fear & Greed Index plummeting into “Extreme Fear” territory. In short, this week’s move was one of the fastest and deepest corrections on record, with markets breaking key support and liquidity evaporating.

This breakaway move feels different from prior soft pullbacks. The dominant narrative has shifted from a “healthy correction” to a possible structural turn. Let’s unwrap the factors that drove this corrections and look at where we go from here. In this week’s Hot Take we discuss why liquidity vanished, who pulled the plug, and what the charts are really hinting at next.

Top-3 stories of the week:

1

2

3

The newsletter is put together by Giottus Crypto Platform. You can read all the previous issues of Cryptogram here.

Was this newsletter forwarded to you?

WEEKLY MACROS

Total crypto market cap - $2.95 trillion - DOWN 10%

Bitcoin price - $85,956 - DOWN 11.6%

The dollar index (DXY) - 100.12 - UP 1%

Bitcoin Dominance - 58.85% - DOWN 1.8%

Crypto Fear and Greed Index - 11 - Market is in Extreme Fear

THE HOT TAKE

Why crypto is tanking

Japan’s surge in super-long JGB yields—with the 10-year near ~1.8% and the 30-year around ~3.3–3.4% this week on fears of a very large ¥25tn+ stimulus and heavier bond issuance — is feeding a global “rates up / liquidity down” impulse. Higher Japanese yields raise the hurdle for global duration and make yen-funded carry trades less attractive; that tends to pull capital back toward Japan and/or force hedged foreign bond positions to be cut. The immediate crypto link is via funding conditions and risk appetite: as global long yields reprice higher and volatility rises, leveraged players reduce exposure, and the most liquid “risk-on” baskets (BTC, majors, high-beta alts) get sold first.

That said, this was not the only driver for this week’s slump.

Liquidity Has Vanished

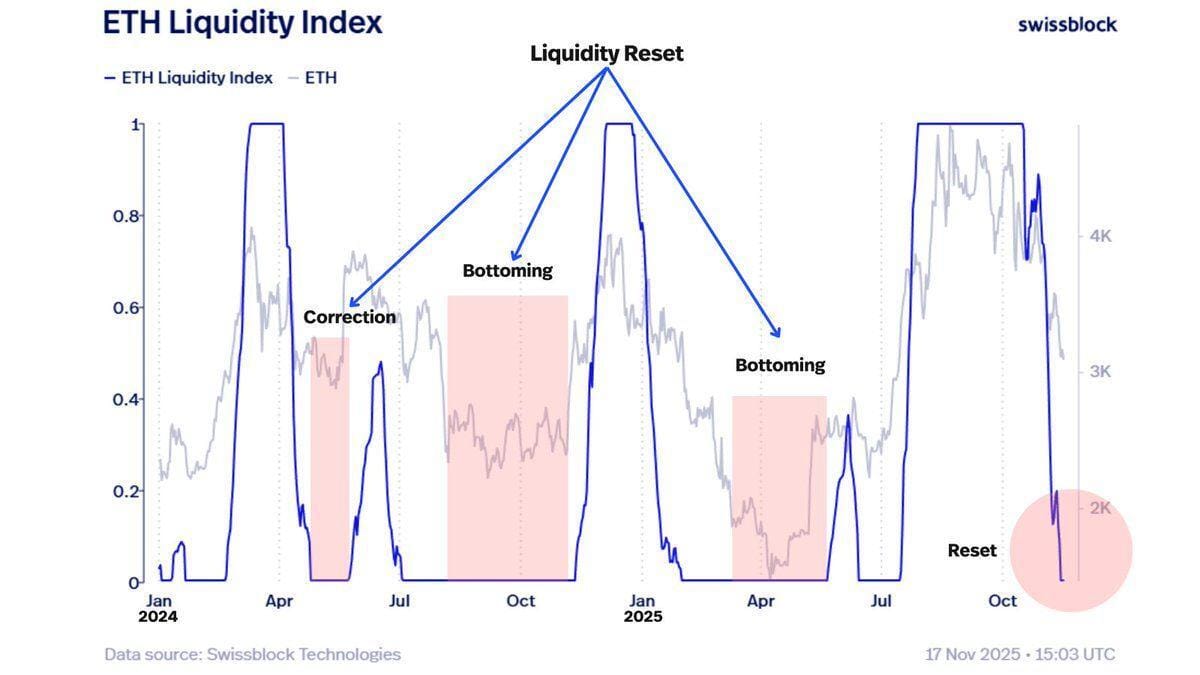

A big part of this drawdown is simply that liquidity has dried up: order-book depth across BTC and ETH is thin, market makers have pulled back, and the bid side feels fragile, so even modest sell flow is moving price far more than it normally would. That creates a reflexive loop — as price slips, liquidity retreats further, leaving an even bigger vacuum underneath — and you can see it most clearly in ETH, which has dropped harder and lost key levels because its depth evaporated faster than Bitcoin’s.

Source: Swissblock on TradingView

In this kind of tape, chart “support” isn’t really support if there aren’t real buyers layered there, so negative impulses like ETF selling, margin calls, or liquidation bursts end up doing outsized damage. The result is a market that behaves less like a healthy pullback and more like a late-cycle air pocket: rebounds struggle to sustain without liquidity first rebuilding, while breakdowns happen faster and with less warning.

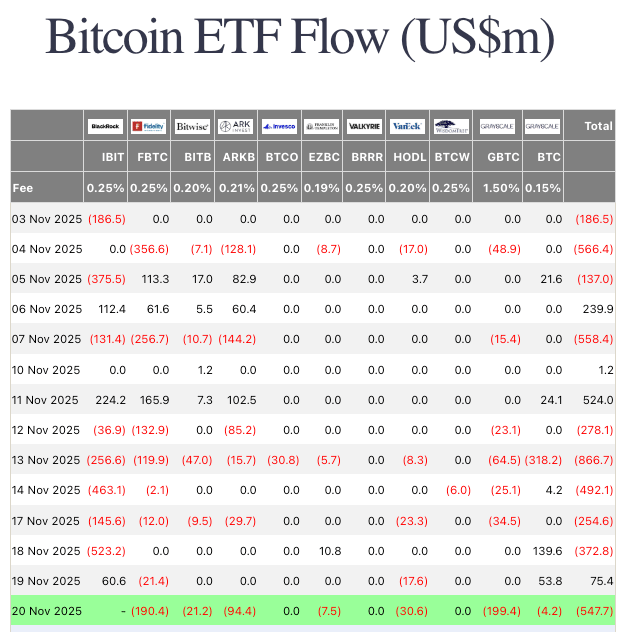

ETF Bid Turns into Supply: Institutions De-Risking

A second, very direct pressure point is the flip in U.S. spot-BTC ETF flows and broader institutional positioning. The same vehicles that steadily absorbed supply earlier in the year have swung into net selling, with roughly $1.1B leaving over a handful of sessions and about $2B bleeding out across the last three weeks. This looks less like panic and more like rules-based rebalancing: macro shifts pushed systematic models to cut BTC risk, and once that persistent ETF bid faded, the market had to reprice to find buyers.

Source: Farside

Redemptions then acted as a spark—larger holders sold into the weakness, retail stops and algos chased the move, and liquidity thinned further. At the same time, long-term holders have been taking profit into a falling tape, adding supply right when demand is weakest (around 815k BTC distributed over the past month from the $40k–$80k cost basis cohort). Put together, it’s a classic institutional rotation moment: new demand has stalled, old money is lightening up, and that imbalance is doing a lot of the heavy lifting in this decline.

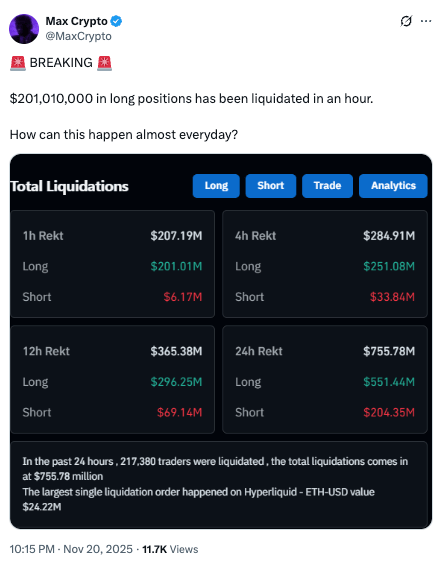

Derivatives Flush: Leverage Coming Out Fast

Derivatives are actively unwinding, and that’s adding a mechanical layer of downside. Options positioning shows a clear scramble for near-term downside protection, while overall open interest is rolling over—traders are paying up for puts and stepping away from risk, not leaning into a bounce. Futures have flipped to negative funding, which is what you see when longs get squeezed out and shorts start controlling the tape. The resulting liquidation wave has been meaningful, forcing systematic selling into already thin books and pushing price lower even without fresh bad news.

Source: MaxCrypto on X

Until open interest stabilises and funding drifts back toward neutral, this reset phase tends to keep pressure on price, the same way it has around prior cycle pivots.

What comes next

Scenario 1: $80K–$85K Drift

If the current pressure points stay in place, the path of least resistance is still lower, with BTC gradually gravitating toward the $80–$85K pocket. The setup is straightforward: ETF selling hasn’t clearly finished, macro remains restrictive, and there’s likely still residual leverage to clear, so any failure to hold recent lows can trigger another leg down.

Scenario 2: $100K–$120K Melt-Up

There’s still a non-zero chance this dip is the reset that sets up one last, sharp melt-up. If positioning is already washed out and sellers are exhausted, a fresh liquidity spark — a dovish policy turn, easing financial conditions, or a meaningful restart in spot demand like steady ETF inflows — can drive a fast, vertical squeeze because the market is under-owned. In that case BTC could snap back above $100K and briefly re-ignite altcoins. You’d confirm it by seeing breakouts backed by real spot volume and sustained inflows, not just short covering. If liquidity doesn’t turn and flows stay negative, this path dies quickly.

Scenario 3: $85K–$95K Range Chop

The middle path is a messy, drawn-out consolidation where Bitcoin just chops sideways in a wide band—say roughly $85K to $95K—while the market waits for a real catalyst. In this setup, liquidity is too thin and sentiment too cautious to fuel a clean rally, but there’s also enough slow dip-buying from longer-term players to keep price from free-falling to the low-$80Ks. You’d recognise this scenario by flattening volume, muted flows, and price repeatedly rejecting both ends of the range without follow-through. It gets invalidated the moment we see a decisive break either way; until then, the base case is boredom: volatility spikes on headlines, then fades, and the market treads water.

For retail traders

Behavioural Guidance: Given the uncertainty, retail traders should cut risk and avoid excessive leverage. This week’s cascade highlights how quickly leveraged longs can unwind. Timeframes should be shortened: trendless or volatile markets reward patience over aggressive plays. In particular, avoid chasing illiquid alts or getting greedy in hopes of quick rebounds. Instead, focus on capital preservation – keep dry powder ready if a clear opportunity emerges (e.g. a genuine bottom signal or sharp bounce on strong volume). This aligns with the broader counsel from analysts: until conditions change, “prudent risk management” is paramount.

Signals to watch: On the technical side, watch Bitcoin’s major levels: a weekly close back above $95–$97K (or reclaiming the 50-week EMA) would be a bullish signal. Conversely, a clean break below the recent ~$88K low could spell more downside. On the flow side, keep an eye on ETF inflows vs outflows. If spot BTC ETFs suddenly switch to net inflows, it could indicate institutional demand returning. Sentiment indicators are also meaningful – for example, CryptoQuant’s Bull Score or the Fear & Greed Index. If these creep out of extreme bearishness, it may presage a turnaround.

Macro Movements: Finally, traditional macro signals matter: Fed announcements, CPI/PPI data, and USD/Gold moves have proven to drive crypto. A pivot in Fed language, or a shock in bond markets, would likely change the outlook. In short, the thesis is data-driven, so let the data guide you rather than narratives.

Final takeaway

In summary, this week’s plunge appears to be the result of multiple stresses hitting crypto simultaneously. Macro forces took center stage: fading hopes of rate cuts and rising yields induced a broad risk-off environment. That removed the backstop for speculative assets and triggered systematic selling.The net effect is a self-reinforcing cycle: selling begets thinner liquidity, which begets more selling.

The outlook hinges on the balance of future flows and macro news. If, for example, the Fed surprisingly shifts dovish or a major buyer emerges, the downward trend could be interrupted . On the flip side, if macro tightness deepens or if BTC fails to reclaim key levels, the sell-off may simply continue. The key thing to watch is whether some of the damage gets healed: a decisive weekly close above the 50-week EMA or a multi-day influx of ETF capital would invalidate the bear thesis. Until we see such confirmation, however, the safer assumption is that the correction regime remains intact.

Was this newsletter forwarded to you?

If you have any questions or feedback for us, write to us at [email protected]. You can check out the previous issues here.

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Please do your own research before investing and seek independent legal/financial advice if you are unsure about the investments.