- Cryptogram

- Posts

- Mantle: another 2025 winner? 🏆

Mantle: another 2025 winner? 🏆

Decoding Mantle trends in August

Decoding Mantle trends in August

22 August 2025

One week we celebrate, the next week, we take a step back. It’s all part of the grind.

We are heading into a mixed time for the markets with macro uncertainties coming back into focus. As always, we hope that this too shall pass.

Bitcoin is still pretty above $113,000 with Ethereum maintaining $4,300. It’s in the healthy correction range.

In a week where altcoins bled, Mantle (MNT) has been surging – a cool 17% up. We cover Mantle in our Hot Take today.

Top-3 stories of the week:

1

2

3

The newsletter is put together by Giottus Crypto Platform. You can read all the previous issues of Cryptogram here.

Was this newsletter forwarded to you?

WEEKLY MACROS

Total crypto market cap - $3.85 trillion - DOWN 6.78%

Bitcoin price - $113,087 - DOWN 7.13%

The dollar index (DXY) - 98.76 - UP 0.9%

Bitcoin Dominance - 59.31% - DOWN 0.17%

Crypto Fear and Greed Index - 50 - Market is in Neutral State

THE HOT TAKE

Mantle gears up for the bull run

Mantle (MNT) staged a strong breakout this week, climbing nearly 30% and retesting the $1.4 level before retracing some gains. The rally was sparked by a mix of fresh liquidity inflows and high-profile exchange developments, including Coinbase International’s listing of MNT futures and Bybit EU’s launch of a MiCA-compliant staking product. These moves have not only expanded MNT’s accessibility for global investors but also bolstered confidence in Mantle’s positioning among leading Ethereum Layer-2 networks. With its market cap now hovering near $4.2 billion, MNT is cementing its place as one of the largest L2 tokens by capitalization. Today, we dive deeper into Mantle and list why it has the potential to spearhead this cycle.

Liquidity & TVL Growth

Behind the price action, Mantle’s fundamentals are strengthening rapidly. TVL in DeFi sits around $230 million, while total bridged assets have surpassed $2.20 billion, including ~$1.6 billion in canonical assets. The real standout is stablecoin growth: supply on Mantle has surged to $749 million from $562 million, a 33% jump in August, with USDT accounting for two-thirds of the total. These inflows have doubled network trading volumes and deepened liquidity.

On-chain activity mirrors this momentum, with daily active users soaring from under 10,000 in early July to nearly 130,000 by mid-August - a 1,300% surge.

Mantle Daily active users saw a sharp surge in July; Source: Dune

Treehouse Protocol, Mantle’s largest dApp, has also seen a 40% uptick in trading volumes, highlighting broader adoption across the ecosystem.

Ecosystem Adoption & Activity

Beyond raw numbers, Mantle’s feature set and partnerships are attracting interest. Mantle’s mETH liquid staking and fBTC bridging products, along with its on-chain MI4 index fund, are key draws. Notably, the MI4 Fund (an on-chain crypto index) recently surpassed $212 million AUM, indicating strong institutional appetite for Mantle-linked products.

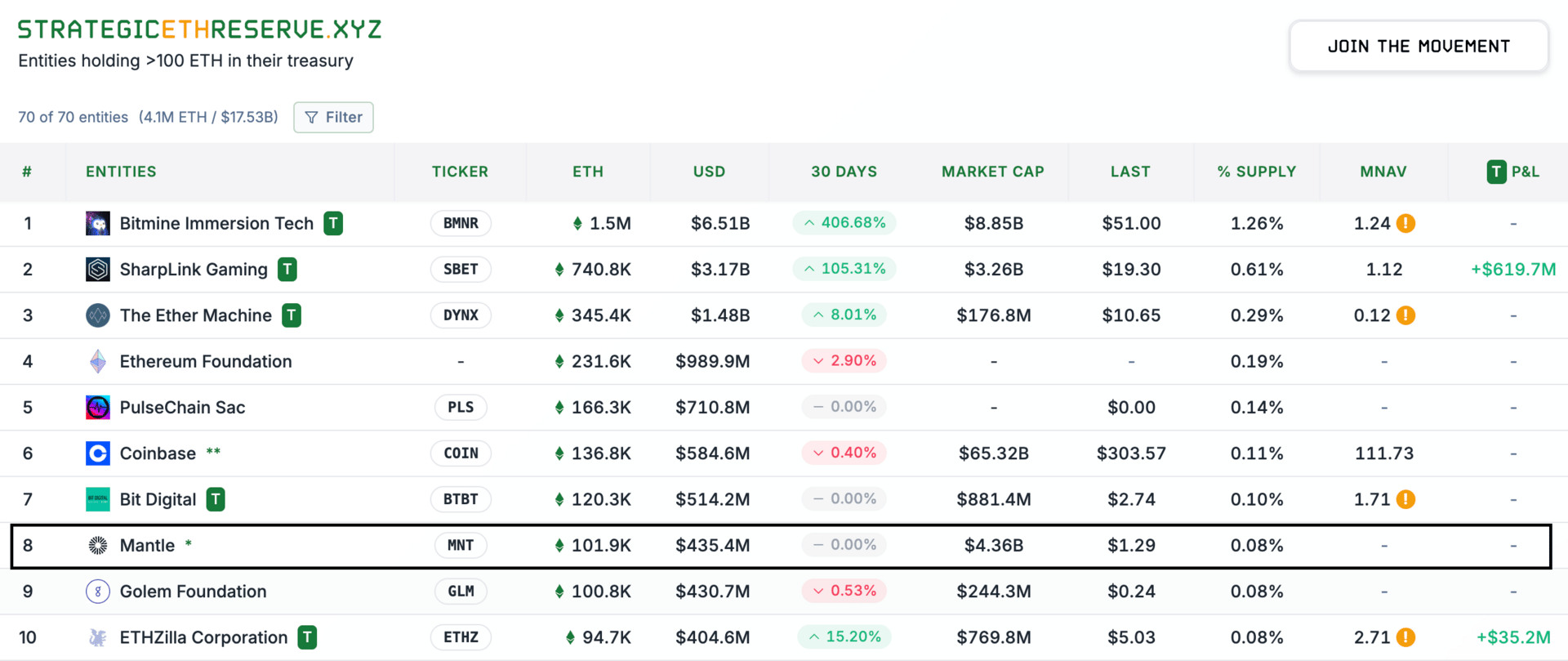

By mid-August Mantle was added to a “Strategic Ethereum Reserve” with a ~101,867 ETH contribution. This move puts Mantle as a major ETH holder. Mantle now ranks among the top 10 largest ETH treasuries.

ETH reserves. Source: https://www.strategicethreserve.xyz/

On the development side, Mantle’s “2.0” roadmap (scaling upgrades) and its new AI research arm (MantleX) are also advancing, though major technical launches are still pending. Meanwhile, the “Citizen of Mantle” NFT collection and other community initiatives aim to broaden its ecosystem.

Together, these factors point to growing real-world use and developer interest.

Staking & Treasury Dynamics

Staking flows have emerged as a key growth driver for Mantle. The network’s non-custodial ETH staking protocol, mETH, has seen rapid adoption thanks to its yield advantage: by distributing rewards from Mantle’s sizeable ETH treasury along with MEV income, mETH has been able to offer APRs slightly higher than competing protocols. This has accelerated TVL growth since its late-2023 launch.

Momentum has also been reinforced by new exchange-linked products. Earlier this month, Bybit EU introduced a MiCA-compliant MNT staking program, expanding access for users to earn yield directly on their holdings. Together, treasury-backed incentives, attractive mETH yields, and exchange listings have driven staking participation to record highs.

Tokenomics & Governance

Mantle’s tokenomics remain a defining feature of its design. MNT carries a total supply of 6.21 billion, with roughly 3.36 billion currently in circulation. Nearly half of the supply (49%) is locked in the Mantle Treasury, a reserve now largely composed of ETH and stablecoins. This pool, valued at well over $1 billion, serves as both a security backstop and a growth engine for the ecosystem. Crucially, its use is governed by token holders, with any major release or expenditure subject to DAO approval.

This structure provides Mantle with unusually deep resources compared to most Layer-2 peers. Treasury assets not only underpin staking yields, by sharing ETH rewards and MEV income, but also finance ecosystem incentives and new initiatives. While no burns or halvings are planned, the gradual unlocking of treasury-held tokens remains an important variable for supply dynamics. For now, Mantle’s model offers a balance of liquidity, community governance, and long-term stability, reinforcing its positioning as one of the most capitalized and strategically funded L2 networks.

Partnership Moves

Longer-term capital flows continue to shape Mantle’s trajectory. World Liberty Financial (WLFI), a Trump-family–backed crypto firm, has steadily built its MNT stake since March, when an initial $3 million purchase lifted the token above $0.80. WLFI’s holdings are now near 6 million MNT, signalling conviction even as its broader portfolio has faced volatility.

Beyond direct investment, Mantle is strengthening its position through key partnerships and integrations. The network became the first Layer-2 to support EigenLayer restaking, while also rolling out new staking campaigns with MEXC and other partners. Coupled with its deep ETH reserves, regulatory-aligned exchange products, and accelerating user adoption, these moves reinforce Mantle’s status as a heavyweight among Ethereum Layer-2s.

Key Takeaway

MNT rallied nearly 30% in mid-August, briefly testing the $1.4 resistance level that now defines its near-term trajectory, a breakout could open the way to $1.6, while rejection risks a pullback. On-chain momentum has accelerated alongside the rally, with stablecoin supply aiding this surge.

Mantle’s ecosystem is maturing quickly. With rising TVL, surging user activity, and key crypto flows (stablecoins, ETH, exchange listings), the network’s fundamentals are strengthening. As always, the next steps depend on execution: clearing the $1.4 barrier and delivering on the Mantle 2.0 roadmap will be critical. For now, the outlook is bullish but closely contested, as traders watch whether MNT can sustain its breakouts and build on this momentum.

Was this newsletter forwarded to you?

If you have any questions or feedback for us, write to us at [email protected]. You can check out the previous issues here.

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Please do your own research before investing and seek independent legal/financial advice if you are unsure about the investments.