- Cryptogram

- Posts

- Lessons from Bitcoin’s October Reset

Lessons from Bitcoin’s October Reset

Tips to survive the crypto shakeout

Tips to survive the crypto shakeout

17 October 2025

Some weeks the market gives. Other weeks, it just grabs the steering wheel and takes us for a wild spin. After flirting with all-time highs, Bitcoin slammed the brakes with a double-digit drop to remind everyone that in crypto, seatbelts are not optional. The charts turned into rollercoasters, funding rates nosedived, and traders suddenly discovered what sleep deprivation really feels like. But every shakeout has its silver lining: it clears the noise, humbles leverage, and resets the stage for what is next.

Bitcoin’s breakout to fresh highs earlier this month felt like confirmation — the rally had matured, sentiment was broadening, and momentum was finally aligned across spot and derivatives. Then, almost overnight, that composure fractured. A cascade of liquidations and sharp rebounds turned the market into a stress test of conviction. Traders who had grown accustomed to steady gains suddenly faced the full force of post-ATH volatility: rapid drawdowns, brief recoveries, and an unmistakable reset in risk appetite. In this week’s Hot Take, we decode the drama, the lessons, and how to keep your head steady when the charts aren’t.

Top-3 stories of the week:

1

2

3

The newsletter is put together by Giottus Crypto Platform. You can read all the previous issues of Cryptogram here.

Was this newsletter forwarded to you?

WEEKLY MACROS

Total crypto market cap - $3.61 trillion - DOWN 12.6%

Bitcoin price - $106,681 - DOWN 11.9%

The dollar index (DXY) - 98.14 - DOWN 1.2%

Bitcoin Dominance - 59.68% - UP 0.6%

Crypto Fear and Greed Index - 22 - Market is in Extreme Fear

THE HOT TAKE

Surviving the Shakeout: Lessons from Bitcoin’s October Reset

Still, what lies beneath has not shifted as dramatically as the price action suggests. The structural demand that underpinned this cycle remains in place — institutional inflows, ETF accumulation, and long-term holder conviction continue to provide depth. What’s changed is the tone of participation: froth has been flushed out, leverage has been humbled, and markets are searching for equilibrium. The next phase will likely reveal whether this correction clears the path for a healthier advance or exposes deeper fragility. Either way, the week’s events mark an inflection point — not the end of the story, but the start of a more disciplined phase of the cycle.

In today’s edition, we unpack the drivers of last week’s wipe-out and provide a practical playbook for retail investors to navigate this kind of volatility with intent rather than impulse.

What happened last weekend?

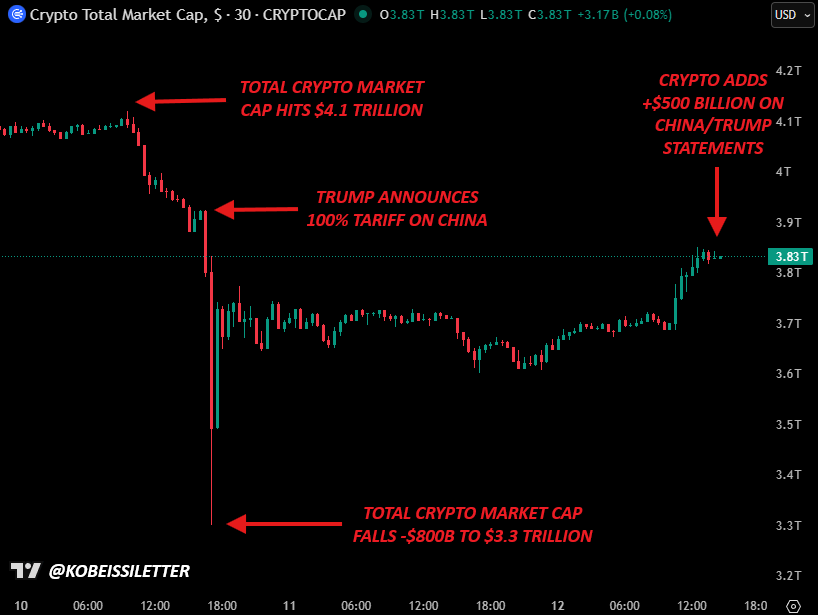

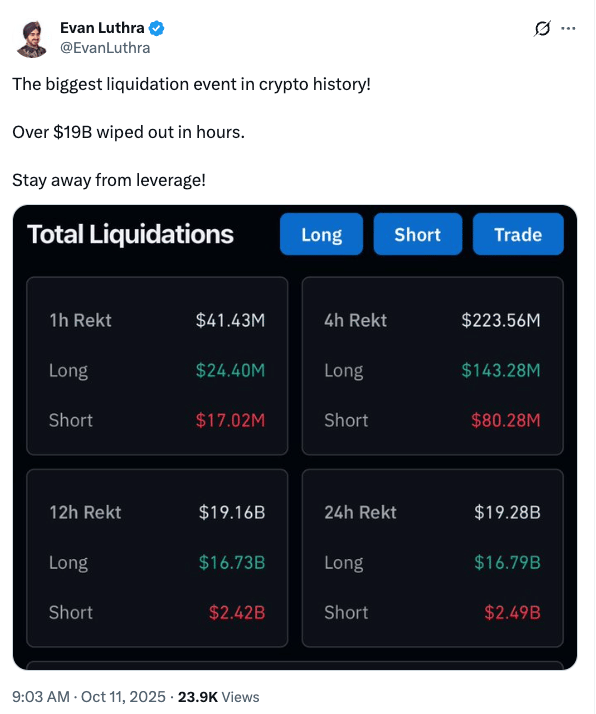

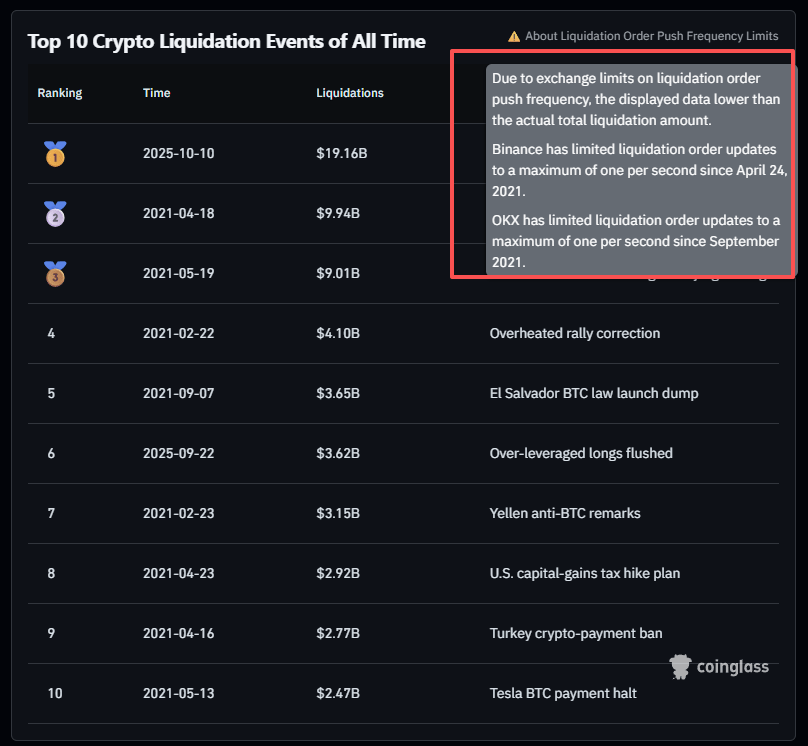

Late last Friday, U.S. President Donald Trump stunned markets by announcing 100% tariffs on all Chinese imports, retaliating against China’s new tech-export curbs. The escalation sent global risk assets tumbling with the S&P 500 fell over 2% that day, and Bitcoin, which had been trading near $122,000, plunged within hours. Between October 10 and early October 11, BTC hit lows around $104,800 (roughly –14% from its pre-tariff high) before stabilising. It was the largest one-day crypto liquidation in history: over $19 billion in leveraged positions were force-closed within 24 hours. Ethereum dropped in tandem, briefly showing an intraday loss above 12%.

Through October 11–12, prices steadied as panic selling subsided. Then on Monday October 13, sentiment improved after Trump’s conciliatory remarks (“it will all be fine,” he suggested over the weekend). Bitcoin rebounded toward $115K, equities rallied, and a brief V-shaped recovery seemed possible. But by Tuesday October 14, fresh trade jitters erased that optimism: the U.S. and China imposed tit-for-tat shipping fees, opening a new front in the trade war. Bitcoin slid back to roughly $110,000 intraday and closed near $113,000, “wiping out Monday’s gains” as Reuters put it. In just five days, crypto markets moved from euphoria to a sudden crash, to a fragile equilibrium at lower levels.

Source: Cryptoqunity

Macro & Micro Drivers:

The episode was a textbook collision of macro panic and micro-structure fragility. The U.S.–China tariff escalation acted as a high-voltage shock to all risk markets. Bitcoin, often framed as “digital gold,” behaved instead like a high-beta asset — amplifying the S&P’s decline rather than hedging it. As selling accelerated, order-book depth vanished. Major exchanges saw market-maker liquidity evaporate within minutes. One striking example came from Binance, where the order book for synthetic USD stablecoin USDe collapsed from roughly $89 million in depth to just $2 million. Prices on some pairs went vertical: USDe, meant to hold $1.00, briefly crashed to $0.65 on Binance.

Meanwhile, auto-deleveraging kicked in across derivatives venues as millions of long positions were forcibly sold into a falling market. With no circuit-breakers in crypto, the sell-off became self-feeding until the weakest positions were cleared. In essence, excessive speculative leverage met a macro spark in a thin-liquidity window, triggering the market’s most severe leverage flush on record.

Source: X

Lessons from Past Crashes: Why This One Feels Different

The October 10–11, 2025 liquidation event will likely be remembered for its sheer scale with roughly $19 billion in leveraged positions erased within a day, making it 9X larger than February 2025’s flash crash and almost 20X the size of the March 2020 or November 2022 meltdowns. But scale doesn’t equal severity. In percentage terms, Bitcoin’s ~14% drop this month was modest compared to the ~50% collapse of March 2020 or the 53% drawdown of May 2021. Those earlier episodes were more violent in depth and panic; this one, while historically large in notional terms, reflected how much the crypto market has grown. Liquidity held up, exchanges stayed functional, and recovery attempts followed within days — a sign that structural maturity, not fragility, now defines the market’s core.

Still, the echoes are familiar. Like March 2020 or November 2022, the trigger came from outside — a geopolitical shock rather than an internal failure. Like May 2021 or August 2024, it struck after an overheated rally driven by leverage and optimism. And in each prior cycle, such flushes became turning points, clearing excess before the next advance. March 2020’s crash paved the way for the 2020–21 bull run; November 2022’s FTX capitulation ended a bear cycle; even May 2021’s collapse preceded a new all-time high by year-end. The pattern is consistent: deep deleveraging is painful but regenerative. If structural demand holds - as current data suggest - October 2025 may ultimately join that list, remembered not just as a wipeout, but as a reset that rebuilt the rally on firmer ground.

Source: Coinglass on X

How Retail Can Cope When the Tide Turns

Survive First, Thrive Later: Every bull run feels invincible — until the floor disappears. This month’s crash was a reminder that markets don’t reward bravado; they reward those who stay solvent. Treat survival as your edge. Risk small, trade light, and let time be your leverage. The 1% rule isn’t just math — it’s humility in practice. Hold smaller alt positions, keep a stable reserve, and know your “I’m wrong” point before you click buy. Staying in the game when others get washed out is how retail wins long-term.

Play Offense by Playing Calm: Great investors don’t react faster — they react less. When panic hits, pre-decided moves beat emotional ones. Ladder your buys (-15%, -25%, -35%) so volatility works for you, not against you. Take some profit on the way up, it’s easier to buy back with confidence if you’ve already booked a win.

Hedge Like a Professional, Even If You’re Not One: Simple protective puts or partial cash-outs can turn chaos into opportunity. Even rotating 20% of your stack into stables near peaks can give you the freedom to buy when fear peaks. Think of it as emotional hedging, because nothing steadies your hand like knowing you have dry powder ready.

Re-Enter with Logic, Not FOMO: After every wipeout, patience is the hardest trade. Build a checklist before you come back in: BTC reclaiming a key level, ETF inflows remaining positive over a week, funding rates normalising. The goal isn’t to catch the exact bottom - it’s to return when the structure looks sane again. In markets like this, discipline is alpha.

Scenarios: The Next 1–3 Months

Base Case – Grinding Recovery (50%): Bitcoin holds the $100,000 – $110,000 zone and oscillates upward toward the mid-$120Ks into early 2026. ETF inflows and stablecoin liquidity form a soft floor, while whale distribution and trade-war nerves cap rallies. Think of this as a market catching its breath — not euphoric, not broken, just climbing a wall of worry.

Bullish Scenario – Higher Highs (30%): In a friendlier macro backdrop — say, tariffs cool or rate-cut chatter returns; Bitcoin could rip past $126 K and test $130,000 setting a new ATH. Institutional FOMO, new ETF approvals, or corporate balance-sheet buys could fuel the run. Alts would wake up later, echoing a mini-alt-season. The key tell: a decisive reclaim and hold above prior highs without leverage getting reckless again.

Bearish Scenario – Deeper Correction (20%): If the macro picture sours — tariffs escalate, equities crack, or a crypto-specific shock emerges; Bitcoin could slide into the mid-$90,000, erasing much of 2025’s gains. Alts would bleed harder, and sentiment could briefly turn despairing. Watch for clues: persistent ETF outflows, rising exchange balances, or funding staying negative. Unless fresh demand steps in, this scenario would test conviction more than charts.

Final Takeaway

The October shakeout was a painful but arguably healthy reset. It flushed leverage and reminded everyone of crypto’s volatility, but it did not derail the broader uptrend supported by long-term investors and fresh liquidity. For a retail investor, the action item is to stay disciplined: size your positions so you can survive 50% swings, hedge or take profits after big runs, and keep cash ready to deploy when fear peaks. The post-ATH phase is treacherous, but it also offers opportunity – if you manage risk first. In short, survive and prepare: the ones who navigated this storm with cool heads and dry powder are now positioned to benefit when the winds turn favorable again. Stay safe, stay patient, and remember – the goal is to stay in the game for the next play.

Was this newsletter forwarded to you?

If you have any questions or feedback for us, write to us at [email protected]. You can check out the previous issues here.

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Please do your own research before investing and seek independent legal/financial advice if you are unsure about the investments.