- Cryptogram

- Posts

- Ethereum: breakout on the cards? 📈

Ethereum: breakout on the cards? 📈

Analysing ETH and its ecosystem

Analysing ETH and its ecosystem

31 January 2025

Chop chop chop. It hasn’t been a great January for traders. Especially the ones who like to use leverage. The market has been volatile with no clear direction emerging.

Bitcoin continues to be trading around $105,000 while most altcoins are in the red on the weekly basis. BTC dominance, currently above 59%, is not relenting.

The question we are asking: When is altseason? When?

Today, we look at Ethereum and what has been ailing the #2 crypto asset over the last 2 years.

Let’s dive in.

Top-3 stories of the week:

1

2

3

The newsletter is put together by Giottus Crypto Platform. You can read all the previous issues of Cryptogram here.

Was this newsletter forwarded to you?

WEEKLY MACROS

Total crypto market cap - $3.55 trillion - DOWN 1.9%

Bitcoin price - 104,267 - DOWN 0.5%

The dollar index (DXY) - 108.2 - UP 0.4%

Bitcoin Dominance - 59.38% - UP 1.4%

Crypto Fear and Greed Index - 76 - Market is in Extreme Greed

THE HOT TAKE

Ethereum needs to show its magic

The second-largest crypto has continued to lag behind Bitcoin (BTC), delivering its weakest bull-cycle performance relative to its larger counterpart since Ethereum’s launch in 2015. A historical analysis of the ETH/BTC ratio across past cycles highlights a persistent trend of underperformance.

Despite this, analysts remain optimistic about Ethereum’s long-term trajectory. With increasing institutional interest, expanding real-world adoption, and bullish technical patterns forming, many believe ETH could be on a path toward the highly anticipated $4,000 milestone in the coming weeks.

In today’s issue, we take a deep dive into Ethereum’s price action, on-chain activity, key trends, and market signals to provide an unbiased outlook on where the asset stands—and where it might be headed next.

ETH/BTC hits new lows

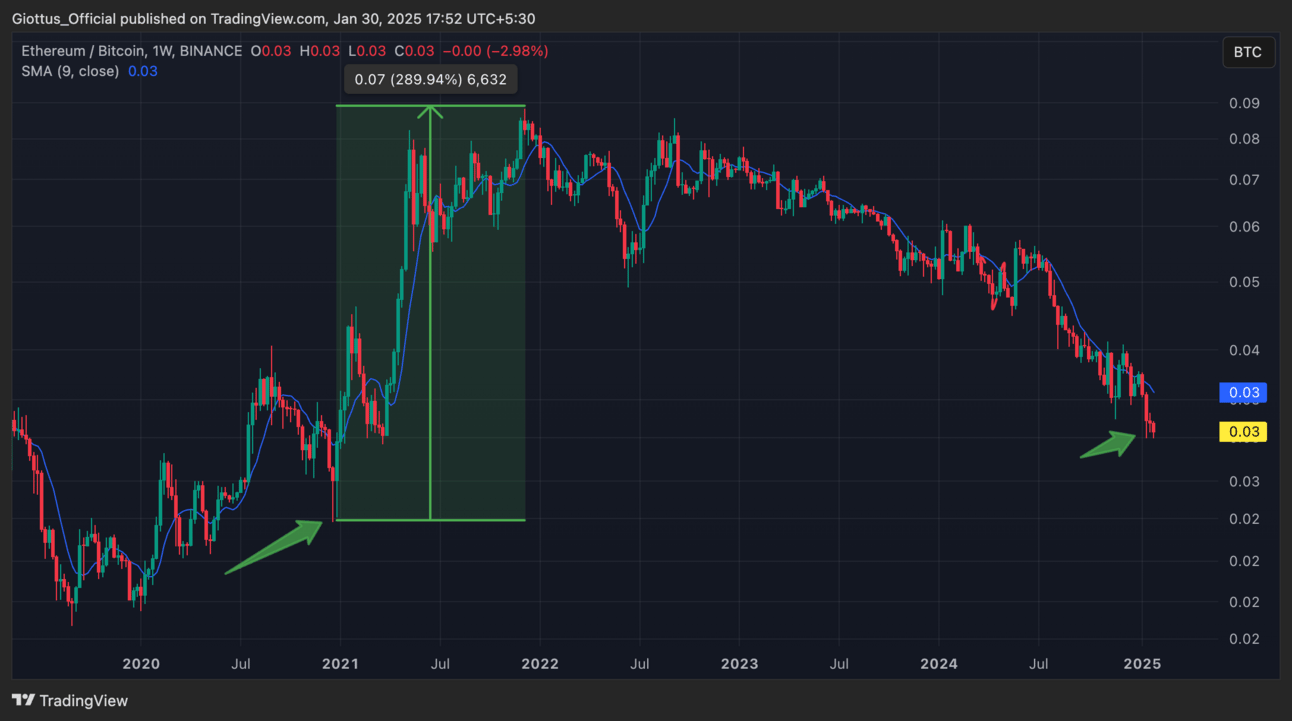

Ethereum’s underperformance against Bitcoin continues, with ETH/BTC making fresh lows while Bitcoin dominance surges to 59.2%. The narrative of BTC’s strength has been relentless, but it's important to take a step back and look at the bigger picture.

If we zoom out, we see a similar pattern in the 2021 cycle. At this same stage, ETH/BTC was even lower, and Bitcoin maximalists were celebrating as BTC dominance hit 63%. Yet, in the months that followed, Ethereum staged a massive comeback—rallying 5x as BTC dominance fell to 40%.

For perspective, if ETH/BTC were to reclaim the 0.08 level seen twice in the last cycle, that would imply an ETH price of $8,000+ at current Bitcoin levels. While Bitcoin remains in the spotlight for now, history suggests Ethereum’s moment may still be on the horizon.

ETH/BTC chart. Source: Trading View

The rise of Layer 2s and its impact on Ethereum

Ethereum’s Layer 1 (L1) faced challenges last year, largely due to the EIP-4844 upgrade. This introduced a new type of data storage called “blobs,” allowing Layer 2 (L2) networks to store transaction data on Ethereum at a much lower cost. As a result, L2 transactions became significantly cheaper, and Ethereum’s main network saw less congestion - leading to lower fees for L1 users.

However, user activity has increasingly shifted to L2s, which is a mixed signal for Ethereum:

Short-term, it’s bearish, as fewer transactions on L1 mean lower fees and revenue.

Long-term, it’s bullish, because more L2 adoption strengthens Ethereum’s ecosystem.

The growth of L2s has been explosive. Today, the top L2s process 10 times more transactions than Ethereum’s main network, compared to just 3x a year ago.

Among L2s, Base is leading the charge, handling 64% of transactions in December, followed by Arbitrum and Optimism. L2s are quickly becoming the dominant force in Ethereum’s scaling landscape.

L1 and L2 transactions. Source: Dune

Staked Ethereum yields has lowered

The total amount of staked ETH has declined slightly after reaching a peak of 35 million ETH (29% of circulating supply). As of today, that figure stands at 34.17 million ETH.

Staking yields have also fallen over time, dropping from 5.5% to around 3% due to two main factors:

More stakers - as more ETH gets staked, rewards are distributed among a larger pool

Lower transaction fees - fewer fees mean less revenue for validators

However, if transaction fees start to rise while the total ETH staked stabilizes, staking yields could rebound. Higher staking yields would not only attract more participants but also enhance Ethereum’s security by strengthening the validator network.

Total ETH Staked. Source: Dune

Ethereum ETFs has room to grow

Ethereum ETFs now hold $11.3 billion worth of ETH, representing 3% of the circulating supply - more than what’s currently held on Layer 2 networks. For comparison, Bitcoin ETFs hold 5.8% of BTC’s supply.

Since ETH’s market cap is about 20% of BTC’s, we believe ETF inflows could start favouring ETH in the later stages of this cycle. Right now, ETH ETFs hold just 9% of the assets that BTC ETFs do, leaving plenty of room for potential growth.

Currently, ETH ETFs don’t offer yield to investors, but this is expected to change. Once yield is introduced, ETH ETFs could become even more attractive - potentially drawing in more institutional demand than BTC.

Key Takeaway

Ethereum may be facing short-term headwinds, but the broader picture suggests a foundation for long-term strength. While ETH/BTC continues to struggle, history shows that Ethereum has rebounded strongly in past cycles especially in Q1 of the year. The rise of Layer 2s, though reducing L1 activity, ultimately enhances Ethereum’s scalability and adoption. Meanwhile, staking dynamics are evolving, and ETF inflows signal increasing institutional interest - with plenty of room for growth.

As market conditions shift, Ethereum’s role in the crypto ecosystem remains as critical as ever. Whether through improved network efficiency, growing adoption, or increased financial products like ETFs, the pieces are in place for ETH to reclaim momentum. While Bitcoin continues to dominate headlines, Ethereum’s moment may be just around the corner.

Was this newsletter forwarded to you?

If you have any questions or feedback for us, write to us at [email protected]. You can check out the previous issues here.

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Please do your own research before investing and seek independent legal/financial advice if you are unsure about the investments.