- Cryptogram

- Posts

- Bitcoin: back in rally mode 🏁

Bitcoin: back in rally mode 🏁

Decoding crypto ecosystem trends

Decoding crypto ecosystem trends

02 May 2025

We have got a break to the upside!

Bitcoin is finally above the critical $96,500 zone and is looking poised to rake in more gains early May. This has been a tough ride for crypto enthusiasts with altcoins plummeting from their January highs. However, things are now more hopeful as Ethereum inches towards $1,900 while Solana is testing $150.

We are not out of the woods yet but signs are positive – we delve into the key drivers of Bitcoin of late and what lies ahead as we settle into May.

Top-3 stories of the week:

1

2

3

The newsletter is put together by Giottus Crypto Platform. You can read all the previous issues of Cryptogram here.

Was this newsletter forwarded to you?

WEEKLY MACROS

Total crypto market cap - $3.01 trillion - UP 2.4%

Bitcoin price - $96,813 - UP 3.3%

The dollar index (DXY) - 99.99 - UP 0.4%

Bitcoin Dominance - 64.82% - UP 1%

Crypto Fear and Greed Index - 67 - Market is in Greedy State

THE HOT TAKE

Can Bitcoin’s rally sustain?

Bitcoin finished April with an impressive 14% gain after two months of bearish price action. Let us try to understand the key trends that have shaped this.

Non-US Institutions are now chasing yield on Bitcoin

This week, Coinbase Asset Management announced a brand-new Bitcoin Yield Fund aiming to deliver 4% to 8% annual returns, using a conservative, market-neutral strategy. What makes this move significant is that Bitcoin, unlike staking assets like Ethereum or Solana, doesn’t natively generate yield. Until now, most BTC yield products came with heavy risk — think uncollateralized loans or aggressive options selling. But Coinbase is going the opposite route, focusing on the tried-and-tested cash-and-carry trade. This is the kind of product that tells you big players don’t just want to hold Bitcoin anymore — they want to work it.

The fund avoids pulling coins out of custody or relying on risky lending desks. Instead, it uses arbitrage between spot and futures markets. And while it won’t be available to US investors, the global appetite for BTC yield products is clearly growing. With a $1 billion capacity and the full weight of Coinbase behind it, this fund adds yet another pillar of long-term support for Bitcoin. Institutions are no longer sitting on the sidelines — they’re structuring products, taking positions, and building infrastructure. This kind of development doesn’t show up in price candles right away, but it reshapes the foundation of the market going forward.

Massive ETF Inflows Signal Confidence

What adds serious weight to this narrative is the ETF inflow data. Last week alone, US spot Bitcoin ETFs pulled in over 31,000 BTC - worth nearly $2.9 billion. That’s the fifth-largest BTC inflow ever, and the third largest in terms of dollar value. Institutions are clearly not scared of buying at $90,000+. In fact, they seem more confident than ever. When new participants are buying and long-term holders aren’t eager to cash out, that’s how sustainable rallies are built.

US Spot ETFs net flows; Source: Glassnode on X

Weak Jobs Data Adds More Fuel to the Fire:

The April US Jobs Report came in far below expectations; just 62,000 jobs added versus the forecasted 114,000. That’s not just a miss; it’s a clear signal that the labor market is cooling faster than many thought. For the US Fed, this creates even more pressure to step in. They’re already caught between sticky inflation and rising unemployment, and now the slowdown in job growth might tip the scale toward earlier rate cuts.

Source: Investing.com

For Bitcoin, this kind of macro backdrop couldn’t be more favorable. Lower rates mean more liquidity, and in risk-on environments, Bitcoin usually catches a strong bid. As markets start pricing in a softer Fed stance, crypto investors are already positioning; and these weak jobs data only strengthens that momentum.

Now, let us understand the key moot point – can Bitcoin’s rally sustain?

On-Chain metrics show strength

Glassnode’s latest on-chain update gives a clear message: this Bitcoin rally isn’t just noise; it’s being driven by real, sustained demand. The data shows that “first buyers” and “momentum buyers” are still showing up in strong numbers. These aren’t just whales recycling old positions or short-term flippers - this is new money, trend-following money, and it’s not being met with heavy profit-taking. That’s a big deal. It means people aren’t rushing to sell into strength. Instead, they’re holding, expecting more upside.

RSI of Cumulative supply for BTC; Source: Glassnode on X

Macro winds are turning - And Bitcoin will benefit

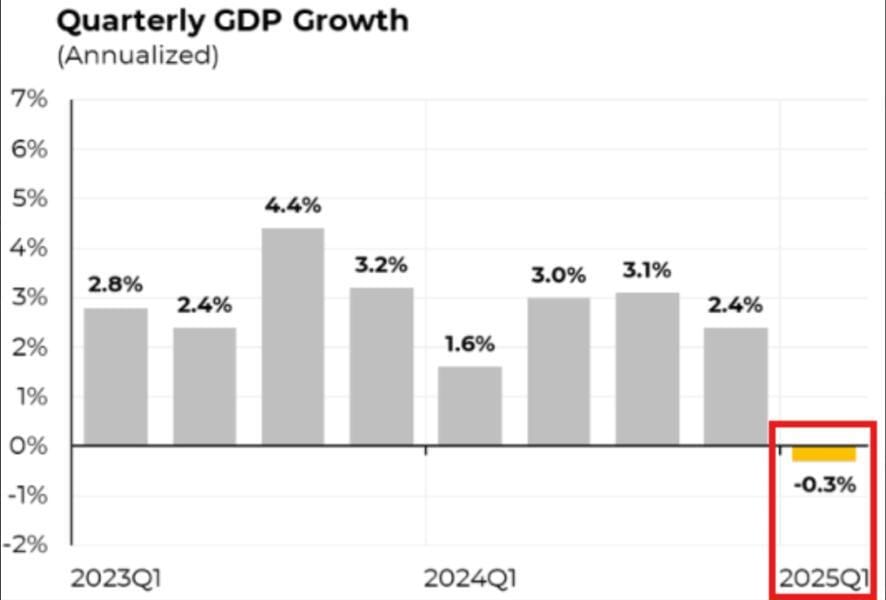

The latest macroeconomic signals out of the US are flashing red, and for Bitcoin, that might be exactly what the bulls need. Q1 GDP data came in unexpectedly negative, and inflation remains stubborn

US quarterly GDP growth. Source: TradingView

The US Fed is now caught between two bad choices: keep rates high and risk deepening a recession, or cut rates and reignite inflation. According to the Kobeissi Letter and other sources, a 2025 US recession is no longer a fringe idea - it’s becoming the base case. In this kind of environment, hard assets like Bitcoin tend to thrive. Investors are already starting to shift their focus, and BTC is moving in step.

According to polymarket, traders are now pricing in a 63% chance of a recession in 2025. This shift in expectations shows just how jumpy markets have become - and how ready they are to front-run a US Fed easing. If the Fed blinks, even slightly, it could trigger a fresh wave of liquidity across risk assets.

Analyst Michaël van de Poppe put it simply: if the Fed starts cutting interest rates, it could mark the bottom for financial markets. That would bring in more money and boost risky assets. And Bitcoin is likely to be one of the first to benefit.

Source: Michaël van de Poppe on X

Key Takeaway

Institutions aren’t just buying, they’re building new ways to earn on BTC, like the Coinbase yield fund. Spot ETF inflows are breaking records, even above $90,000. At the same time, weak job numbers and slowing GDP are pushing the US Fed closer to rate cuts - and that’s a setup Bitcoin usually loves.

On-chain, we’re seeing fresh demand come in without major selling pressure, which shows people are in this for more than just a quick flip. There’s no telling what happens day to day, but with everything lining up - macro, flows, and sentiment - this rally might just have legs.

Was this newsletter forwarded to you?

If you have any questions or feedback for us, write to us at [email protected]. You can check out the previous issues here.

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Please do your own research before investing and seek independent legal/financial advice if you are unsure about the investments.