- Cryptogram

- Posts

- As Bitcoin Stumbles, HBAR Steals the Show

As Bitcoin Stumbles, HBAR Steals the Show

How HBAR danced off-script

How HBAR danced off-script

31 October 2025

When the world’s most powerful central bank pulls a lever, markets usually dance. This time, they tripped over their own feet. The US Fed’s rate cut was meant to ease nerves, but Bitcoin reacted like someone had yanked the plug mid-song to slide back toward $104K as leverage collapsed in a flash. Nearly $1 billion in positions vanished before traders could blink. Still, amid the wreckage, one name refused to follow the script: HBAR. Backed by an ETF debut and real-world adoption wins, it turned chaos into opportunity. In this week’s Hot Take, we break down how a market built on liquidity managed to choke on it—and why a token built on fundamentals kept its composure.

The crypto market has whipsawed following the U.S. Federal Reserve’s latest policy shift. Hours after the Fed delivered a widely expected 0.25% rate cut and signaled an end to quantitative tightening, Bitcoin sold off in a classic “sell-the-news” move. BTC plunged to nearly $104,750— revisiting its local range floor—as overleveraged longs were forced to unwind. Roughly $1.1 billion in futures positions were liquidated in less than a day, with about 165,000 traders caught offside. This long wipeout punished recent upside chasers and yanked BTC back toward support, indicating how fragile speculative leverage can be in the face of macro surprises.

Yet beneath the volatility, crypto’s structural underpinnings remain in play. Spot demand from institutions—via products like ETFs—is still providing a backstop, even as short-term traders de-risk

Top-3 stories of the week:

1

2

3

The newsletter is put together by Giottus Crypto Platform. You can read all the previous issues of Cryptogram here.

Was this newsletter forwarded to you?

WEEKLY MACROS

Total crypto market cap - $3.68 trillion - DOWN 1.08%

Bitcoin price - $109,769 - DOWN 0.64%

The dollar index (DXY) - 99.49 - UP 0.46%

Bitcoin Dominance - 59.91% - DOWN 0.03%

Crypto Fear and Greed Index - 29 - Market is in Fearful state

THE HOT TAKE

Sell-the-News to Stand-Out Moves: HBAR’s Week in Spotlight

While Bitcoin and most majors sank post-Fed, HBAR leapt on a wave of positive catalysts— from enterprise network adoption to a newly launched U.S. spot ETF. This rare relative strength hints at a rotation of capital into assets with distinct narratives and fundamentals.

The thesis: leverage may have been flushed, but quality coins with real-world traction (like HBAR) are catching a bid.

Below, we unpack why Bitcoin faltered despite easier Fed policy, how the leverage purge resets the playing field, and what’s driving HBAR’s outperformance—plus a playbook for traders looking to navigate HBAR’s next moves.

The Market Context: Bitcoin & Macro Backdrop

The Fed Cut & Market Reaction

On 29 October, the Federal Open Market Committee cut its benchmark rate by 25 basis points to roughly 4.00–4.25%, and officials indicated an imminent halt to balance sheet reduction (QT). In theory, such easing is bullish for liquidity-sensitive assets. However, crypto markets sold off anyway.

Why?

Traders had fully priced in the cut, and Fed Chair Jerome Powell’s tone turned out to be more hawkish than hoped. Powell explicitly warned that a December rate cut is “not guaranteed,” emphasizing persistent inflation risks. That cautious outlook surprised some optimists and triggered a risk-off response. Instead of celebrating cheaper capital, traders fixated on the implication that the Fed might pause easing if economic data doesn’t soften. In short, it was a textbook “buy the rumour, sell the news” scenario: the absence of a dovish surprise led speculators to cash out. Real yields also remain high (US inflation is ~3% against policy rates over 4%), so the real monetary stance is still restrictive. With liquidity conditions still tight and the U.S. dollar firm, crypto lacked an immediate macro tailwind. Volatility was quickly repriced— the anticipated Fed cut turned into a non-event for crypto, or even a slight negative, given Powell’s prudence.

Liquidations & Perps Dynamics

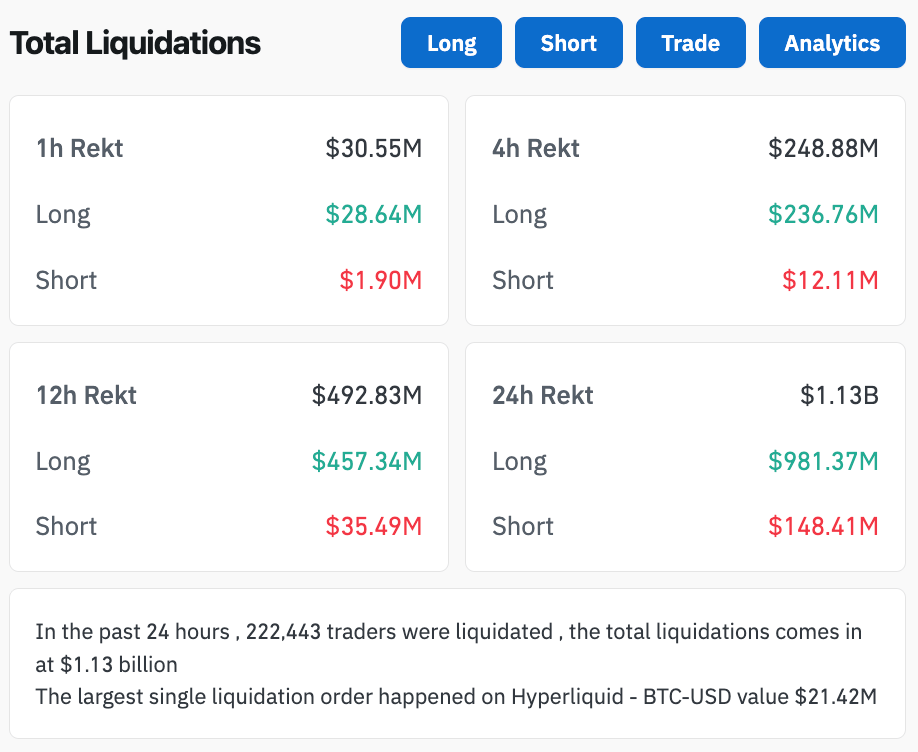

The post-FOMC downturn was exacerbated by a cascade of long liquidations that punished overly bullish positioning. Within 24 hours of the Fed announcement, $1.1 billion worth of crypto futures positions were liquidated with the vast majority of them ($983 million) long bets. CoinGlass data showed about 222,436 traders hit margin calls, including a single $21 million BTC long on Hyperliquid that went up in smoke.

Liquidation Data; Source: Coinglass

A silver lining of this pain is a healthier derivatives setup going forward. After such liquidation events, funding rates on perpetual swaps tend to normalize or even dip negative as bullish excess is flushed.

Reclaim or Flush?

What happens next hinges on whether bulls can defend support and reclaim lost ground. On the downside, the line in the sand is the $107K area. A decisive daily/weekly close below that level would mark a clear range breakdown and could open the door to deeper retracements (next supports might sit around $104K or lower). Short-term, traders are watching if BTC can hold the high-$100Ks. On the upside, $114K–$116K has become a stubborn ceiling.

A few days ago, bulls needed a strong weekly close above ~$114,500 to confirm a breakout and negate the risk of a bull trap. That didn’t happen—instead we got rejection and reversal. So now that same region is the hurdle to reclaim. If Bitcoin can grind back above ~$114.5K and secure acceptance there (say, a weekly close in mid-$115K+), it would signal that the recent drop was merely a shakeout and the uptrend is resuming. Until then, consolidation prevails.

HBAR as an Outlier: Why It Decoupled

Relative Strength & Market Flows

Amid late October’s crypto pullback, Hedera’s HBAR stood out as a notable outperformer. From October 25 to 30, when Bitcoin slid roughly 4% and many altcoins followed suit with double digit decline, HBAR managed to perform well. This decoupling was evident in market-wide stats: an “altcoin season” index that tracks broad alt performance actually fell in late October, reflecting most alts losing momentum, yet HBAR bucked the trend. In practical terms, HBAR was one of the only large-cap tokens printing a double-digit gain alongside Hyperliquid (due to heavy perps activity) while peers like Solana and XRP were flat or down. That relative strength did not go unnoticed—it attracted further rotation into HBAR from traders seeking shelter in a coin with positive momentum.

Volume Surge Signals Inflows

The rally in HBAR was accompanied by a surge in trading volume, suggesting real flow aiding the price move. Daily turnover in HBAR jumped dramatically during the week. By October 28–29, HBAR’s 24-hour volume had leapt 344% to about $871 million—up from roughly $196M prior. Some data sources even showed higher spikes; internal exchange figures noted volume on certain venues jumped 5–7x compared to earlier in the month. This explosion in activity, even as overall crypto volumes were tepid, points to fresh spot buying interest in HBAR. Notably, this was not purely algorithmic churn; the catalyst (discussed below) brought in both retail traders and some funds targeting HBAR specifically.

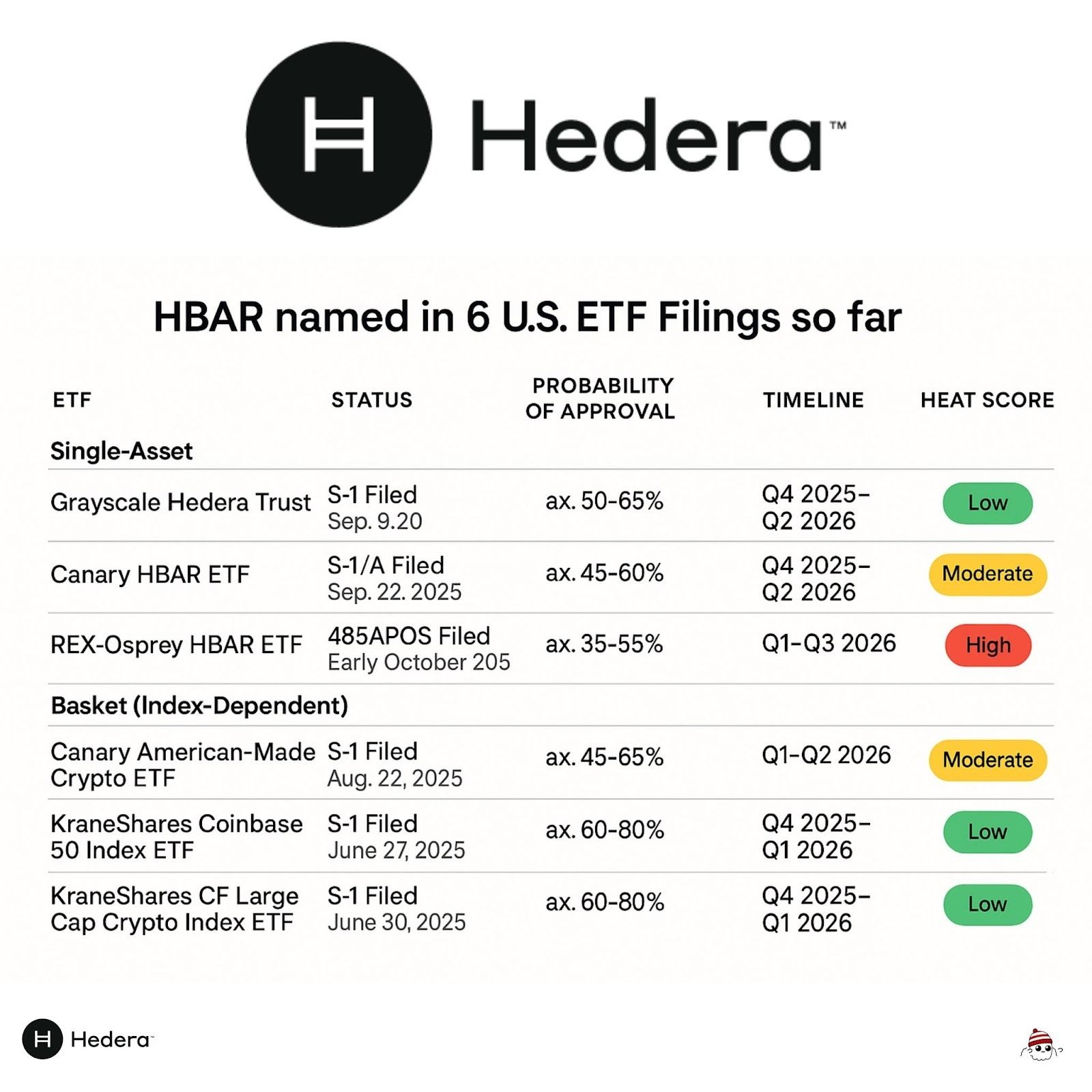

The ETF and Beyond: The most headline-grabbing was the launch of a U.S. spot ETF for HBAR. The Canary Capital Hedera ETF (ticker: HBR) began trading on NYSE Arca this Wednesday. This made HBAR one of only three cryptos (alongside Bitcoin and Ether) to have a spot ETF in the U.S., a significant validation of Hedera’s stature. The ETF’s debut, with regulated custody (BitGo and Coinbase), signalled to the market that institutional gateways for HBAR are opening. It also has 6+ ETF approvals pending near term.

Source: Gilmore Estates on X

Enterprise Catalyst: Beyond the ETF, Hedera’s ongoing enterprise adoption story has been gathering steam. In recent weeks, there have been notable developments such as Arrow Electronics, a $28B global tech firm—joining Hedera’s governing council and integrating its blockchain for supply chain optimization.

Additionally, Hedera’s technology is being tapped in real-world pilots. For example, it’s involved in Australia’s Project Acacia, (a central bank digital currency trial by the RBA) and powers the AUDD stablecoin for Australian payments, where over 70% of retail transactions flow through a network (AP+) that leverages Hedera’s infrastructure.

Ecosystem Momentum and Narrative: Hedera’s positioning as an enterprise-grade ledger gives it a unique appeal: it’s not competing on yield farming or memecoin trends, but on providing infrastructure for things like payments, identities, and tokenized assets. As macro uncertainty rises, some investors rotate into projects that have tangible partnerships and cash-flow potential (e.g. through enterprise usage fees). Hedera fits that bill—its fixed fee model means usage translates to predictable network revenue (paid in HBAR), which in theory can be valued more like a tech stock’s revenue than a speculative asset.

Can it sustain the momentum?

Whenever a token posts double digit gains, the biggest risk is jumping in late, only to get caught in a pullback. The first breakout often lures in FOMO buyers before a retest. For HBAR, that pivotal breakout level is around $0.206. This was the resistance it cleared on ETF day and then struggled to hold. Traders would be wise to wait for HBAR to prove itself above such levels. If HBAR can reclaim and consolidate above $0.21 with strong volume, it increases confidence that the uptrend is resuming rather than a one-off spike. Conversely, if it continues to languish below $0.18, that signals the breakout failed and more range-bound or corrective action is ahead. The motto here: don’t buy the first green candle into resistance. Instead, let the market validate that demand exists at higher prices

Finally, before entering any trade, know your invalidation level—the price at which your trade thesis is proven wrong. For example, if you’re trading a breakout above $0.21, an invalidation might be a drop back below $0.20 (meaning the breakout failed). Setting this in advance helps remove emotion. Importantly, respect those stops if hit. Likewise, avoid holding huge positions into known event risk. If, say, the calendar has another Fed speech, a major economic data release, or even a big Hedera token unlock (if any were scheduled), reduce or hedge positions beforehand. Events can produce whipsaw volatility that no technical setup can predict.

Closing

Stepping back, HBAR’s recent strength amid a weak tape is an encouraging sign—but not definitive proof of a new market regime. It shows that quality projects can shine even when the crypto tide goes out, potentially rewarding those who do their homework on fundamentals. If Bitcoin stabilises (or resumes its uptrend) and institutional flows via ETFs keep trickling in, HBAR is well-positioned to lead a recovery rally. Its mix of enterprise adoption and now easier investor access could make it a prime candidate for outperformance.

In volatile markets, the winners are those who can identify genuine strength, trade it without overleveraging, and step aside when conditions turn. HBAR’s story this week embodies that ethos: a fundamentally strong asset breaking higher despite the market, yet requiring discipline to trade successfully. As always, keeping a level head and a data-driven approach will separate opportunistic gains from painful traps.

Was this newsletter forwarded to you?

If you have any questions or feedback for us, write to us at [email protected]. You can check out the previous issues here.

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Please do your own research before investing and seek independent legal/financial advice if you are unsure about the investments.